change in net working capital formula dcf

Therefore the most used and theoretical sound valuation method for. Current Operating Assets 50mm AR 25mm Inventory 75mm.

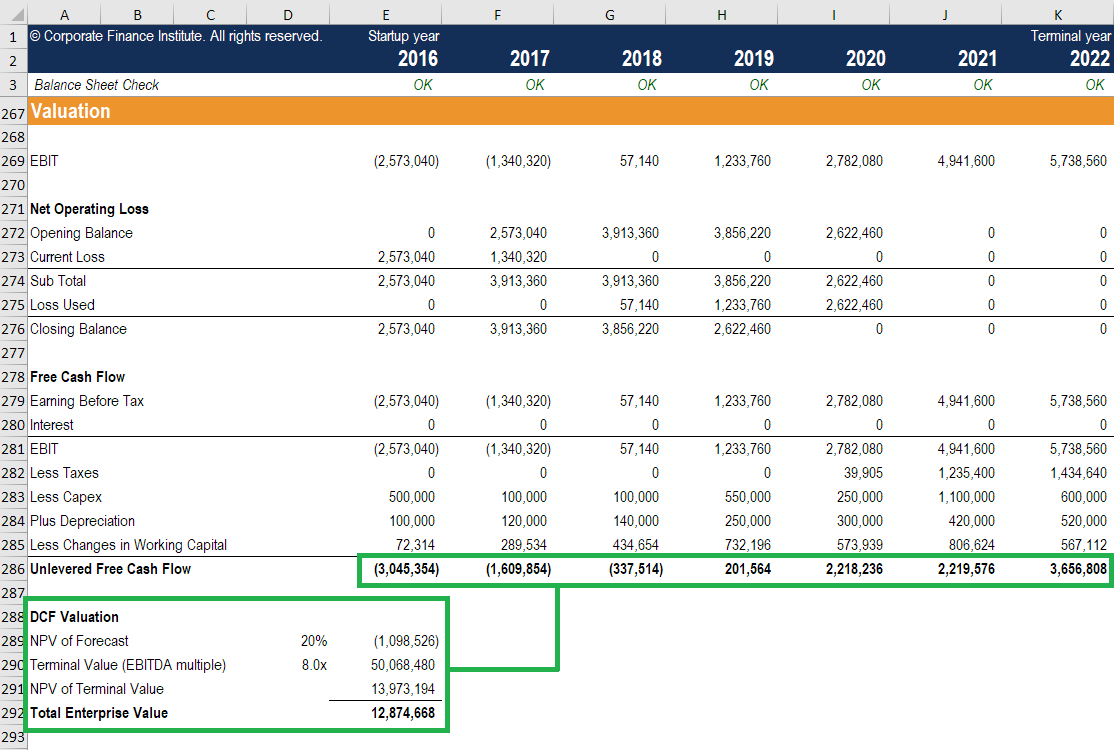

Dcf Model Training The Ultimate Free Guide To Dcf Models

The non-cash working capital for the Gap in January 2001 can be estimated.

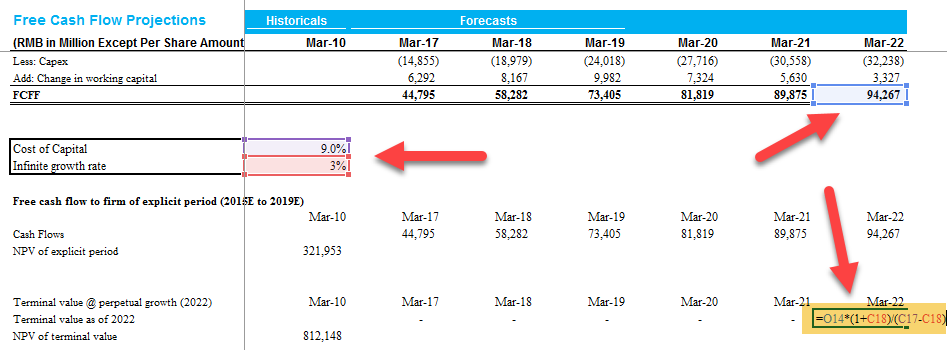

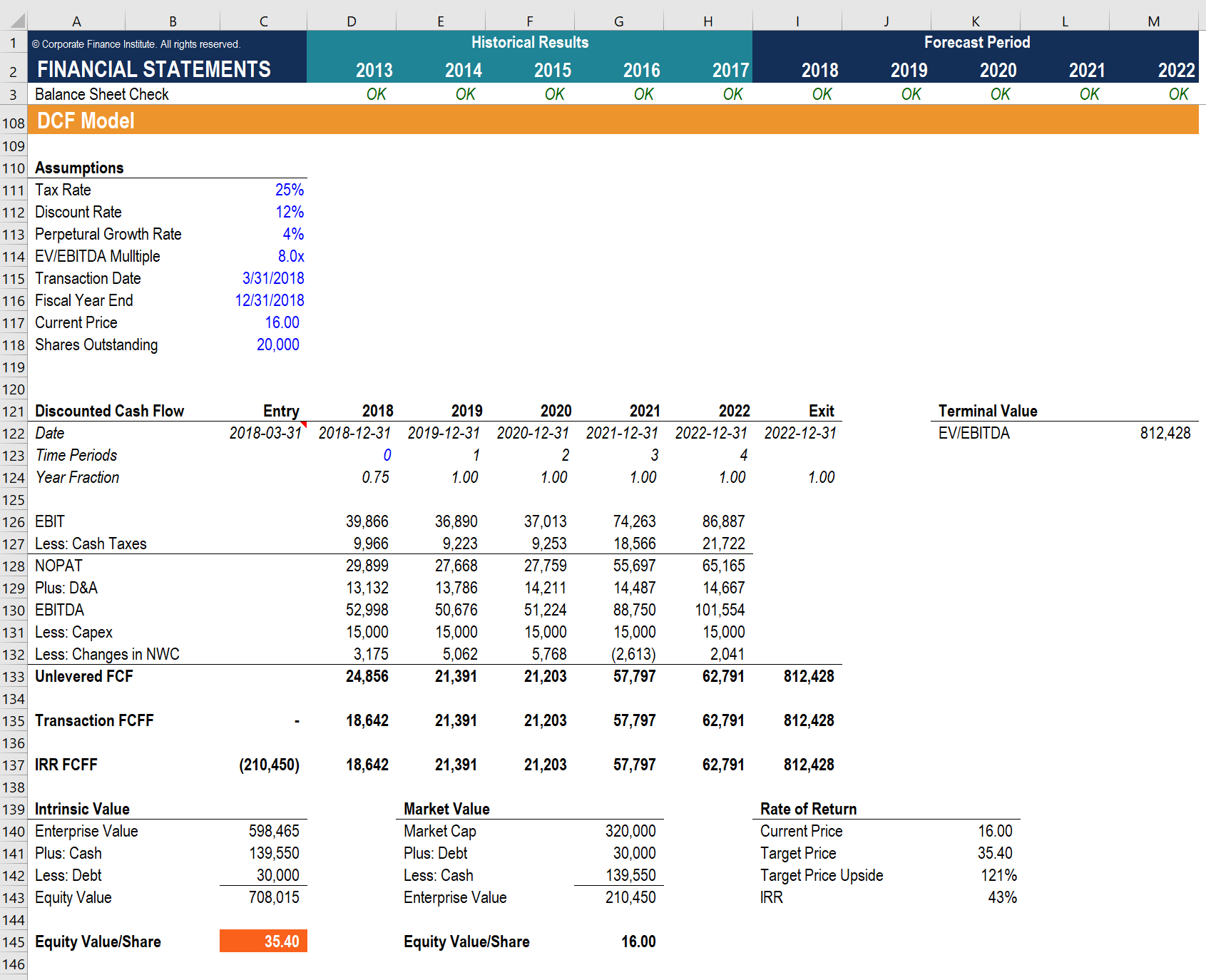

. Non-cash working capital 1904 335 - 1067 - 702 470 million. It still counts as cash that is tied into running the day to day operations of the business. The discounted cash flow DCF valuation is used to calculate the present value of a firm by discounting the expected returns to their present value by using.

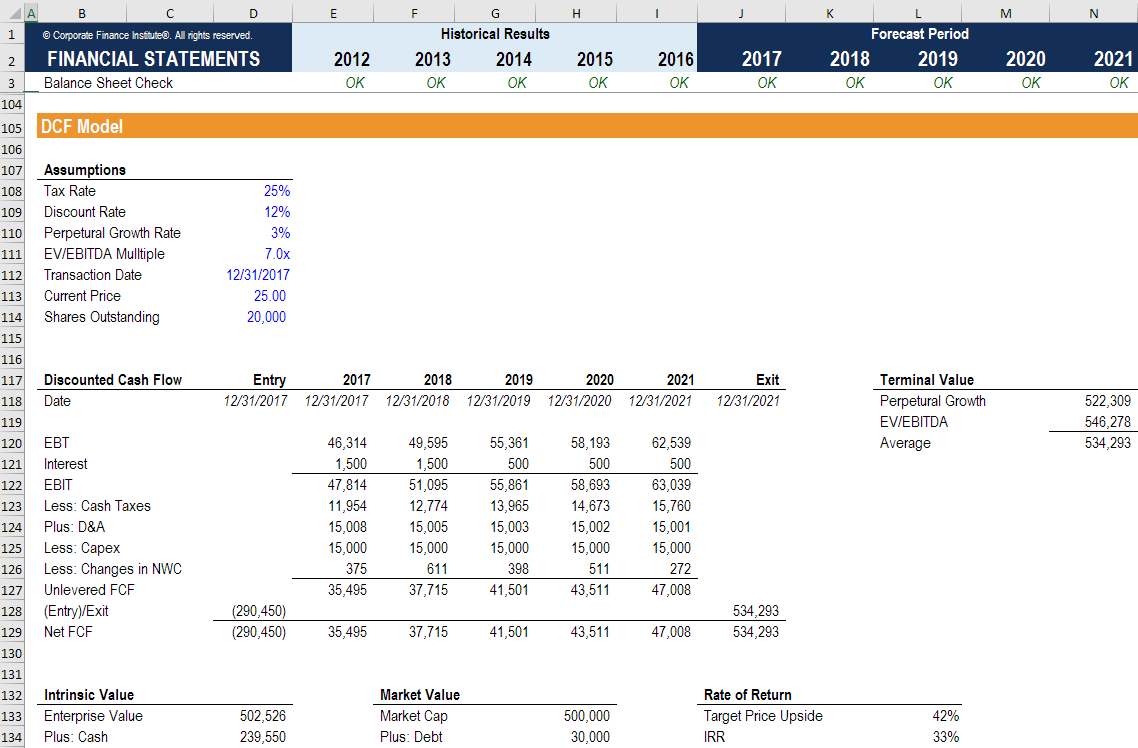

The discounted cash flow model commonly referred to simply as DCF is one of the most used methods to value a company. The Change in Working Capital gives you an idea of how much a companys cash flow will differ from its Net Income ie after-tax profits and companies with more power to collect cash. The formula is.

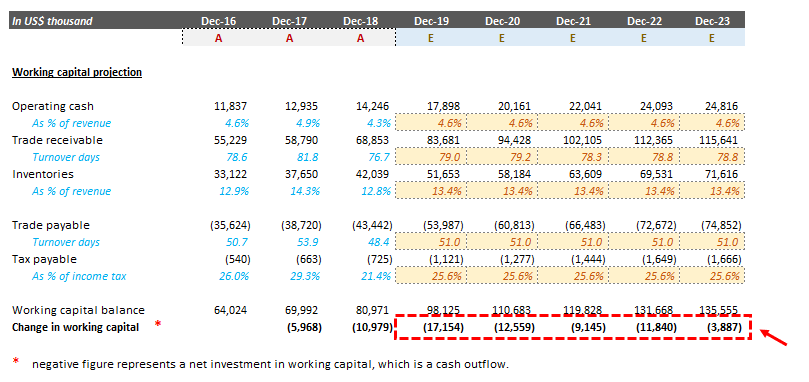

Working capital increases. Here are some examples of how cash and working capital can be impacted. And Change in Net Working Capital is an integral part to arrive at the value of Free Cash Flow which is used in valuation and financial modelling.

Free cash flow decreases. Net Working Capital NWC. Changes in working capital are reflected in a firms cash flow statement.

If a transaction increases. FCFF NOPAT D. Changes in working capital -2223.

Moving to cash flow statement - net. If a transaction increases. Lets start with the numbers - revenue is up 100.

In-depth Explanation of Working Capital. Discounted Cash Flow Valuation is a form of intrinsic valuation and part of the income approach. Owner Earnings 8903 14577 5129 13312 2223 13084.

The change in net working capital formula is given as N E B where E is ending net working capital and B is beginning NWC. Given those figures we can calculate the net working capital NWC for Year 0 as 15mm. In Table 1010 we report on the non.

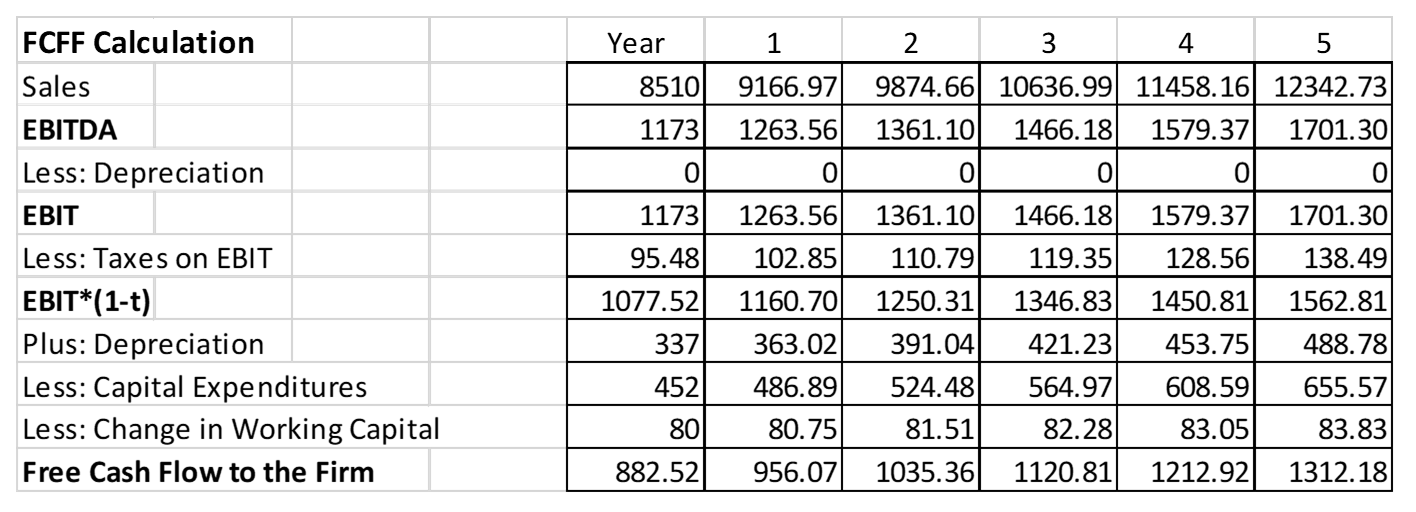

Cash Flows from Operations is calculated as. In this case the change in working capital is computed using the formula above and it is dramatically less. Calculate FCFF Free Cash flow to the firm.

All else held constant this results in net income up 60 assuming a 40 tax rate. For most companies you analyze by using the change in working. When you use the lower number for changes in working capital and then.

FCF EBIT1-Tax Rate Depreciation and Amortization Capital Expenditures Increases in Net Working Capital NWC. Heres the formula for free cash flows Ill be referring to. When they report a net income of 15 million but only pay out 5 million it.

For example a bank with a 5 Tier 1 capital ratio can make 100 in loans on each 5 in equity capital. Current Operating Liabilities 40mm AP 20mm Accrued Expenses 60mm. Free cash flow decreases.

For this in a separate sheet also calculate NOPAT and CWC. You include change in cash as a part of change in overall working capital. Working capital changes can make cash flows lumpy and simply putting last years or the trailing twelve month free cash flow number into a DCF model could produce wild.

Under ordinary operating conditions many if not most companies have positive working capital current assets exceed.

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Explaining The Dcf Valuation Model With A Simple Example

Dcf Formula Calculate Fair Value Using Discounted Cash Flow Formula

Projecting Net Working Capital For Free Cash Flow Calculation Dcf Model Insights Youtube

Change In Working Capital Video Tutorial W Excel Download

Discounted Cash Flow Create Dcf Valuation Model 7 Steps

Change In Net Working Capital Nwc Formula And Calculator

Fcf Formula Formula For Free Cash Flow Examples And Guide

Change In Net Working Capital Nwc Formula And Calculator

Changes In Net Working Capital All You Need To Know

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Discounted Cash Flow Analysis Veristrat Llc What S Your Valuation

Change In Working Capital Video Tutorial W Excel Download

Training Modular Financial Modeling Ii Dcf Valuations Equity Dcf Valuation Modano

Change In Net Working Capital Nwc Formula And Calculator

Dcf Formula Calculate Fair Value Using Discounted Cash Flow Formula

Change In Working Capital Video Tutorial W Excel Download

Dcf Terminal Value Formula How To Calculate Terminal Value Model